Salary

modified: vitas@smarton.app| Salary |

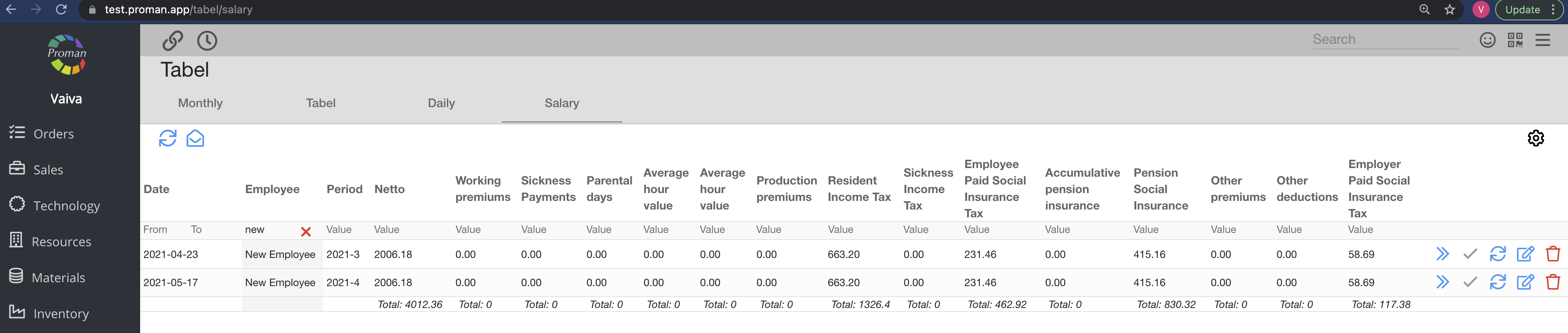

Here you can see all generated Employees' salaries.

| Button | What does it indicate? |

| Buttons in top | |

| You could generate the salary for all employees |

| You could send Template to Employee |

| Buttons in every line | |

| You could go to Employee's salary |

| You could confirm the salary (confirmed salary has button  ) or unconfirm the salary (unconfirmed salary has button ) or unconfirm the salary (unconfirmed salary has button  ) ) |

| You could generate the salary for particular employees |

| You could edit all taxes and salary |

| You could delete generated salary |

| Row | What does it indicate? | How it is calculated? |

| Date | Date of the record created | |

Employee | Employee name and surname | |

Role | Employee role | |

Specialisation | Employee specialistaion | |

Period | Salary period year-month | |

Netto | Netto salary | |

Brutto | Brutto salary | Brutton salary comes from the contract |

NPD | ||

Basic monthly salary (bma) | Worked hourly value * (Haurly salary or Brutto salary / Worked hourly value) | |

Basic monthly hours (bmv) | ||

Month working hours (dmv) | ||

Worked hourly value (dmvv) | ||

Overtime hours (vv) | ||

Overtime premiums (vvv) | Worked hourly value * overtime hours * overtime rate | |

Night working hours (nv) | Hours employee worked at night | It comes from the schedule |

Night working payments (nvv) | Worked hourly value * Night working hours * Night rate | |

Weekend working hours (sv) | ||

Working premiums (svv) | Worked hourly value * Weekend working hours * Holiday rate | |

Holidays hours worked | The value of worked hours during the holidays | |

Holidays worked value | Worked hourly value * Holidays hours worked * Holiday rate | |

Days of sickness (ld) | Days of sickness that are written in the employee schedule | |

Sickness Payments (lp) | Days of sickness * average salary * sickness coefficient / 100 * contract work hours | |

Parental Payments (mmd) | ||

Average hour value | ||

Production premiums (ppp) | ||

Resident Income Tax (gpm) | ||

Sickness Income Tax (gpmlp) | Sickness Payments * Gpm rate/ 100 | |

Employee Paid Social Insurance Tax (sd) | ||

Accumulative pension insurance % | ||

Accumulative pension insurance sum | ||

Pension Social Insurance (psd) | ||

Other premiums | ||

Other deductions | ||

Employer Paid Social Insurance Tax (dmsdm) | ||

Unemployment insurance paid by employer (dmbdd) | ||

Unemployment insurance paid by employee (bdd) | ||

Employeer taxes discount (dmtl) | ||

Progressive income tax (pit) | ||

Tax-free part (pnpd) | ||

Stamp tax (stamp_tax) | ||

Accumulated yearly salary (ays) | ||

total | Total employee cost | Brutto |

Vacation payments | Vacation days * average salary * contract work hours | |

Vacation days | ||

Variable part |